The upswing isn’t over

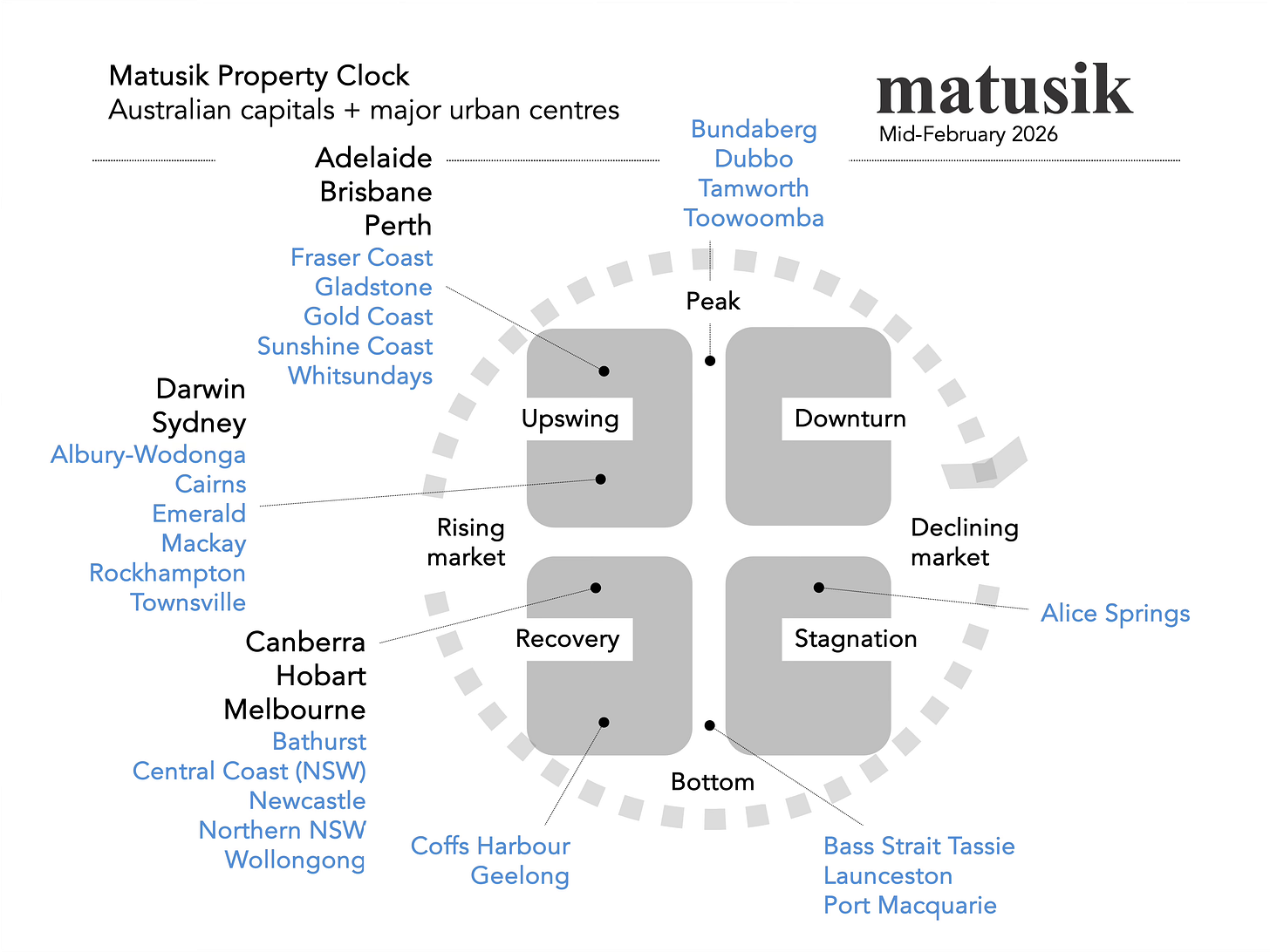

What my latest Property Clock says about market positions and the year ahead

Synopsis

Australia is not heading into a uniform housing downturn. Despite rising interest rates, most markets - including all eight capitals - remain in recovery or upswing. The cycle, however, is maturing. Activity is slowing, price growth is moderating and markets are fragmenting by product and location. After dwelling values rose almost 9% in 2025, 2026 is shaping as a year of slower, uneven gains.

Introduction

Twice a year I update my Property Clock to cut through the noise and show where Australia’s housing markets sit - in my view - in the cycle. This latest update reinforces a key theme from my last post: despite rising interest rates, most markets - including all eight capital cities - remain in the recovery or upswing phase.

Higher rates won’t reverse the cycle, but they will dull it, reducing activity and price growth relative to what would have occurred if rates stay on hold. After dwelling values rose almost 9% in 2025, momentum is clearly easing. Supply shortages remain structural, but borrowing costs are rising and markets are fragmenting.

In 2026, prices are still likely to rise - just more slowly and unevenly - with 2% to 6% growth looking realistic and this year likely marking the tail-end of the current upswing.

Revisit

Sydney

Sydney enters 2026 with tight listings, deep pools of wealth and solid demand, but limited margin for error. The 2025 recovery showed growth now depends on borrowing capacity, not scarcity alone. Houses should outperform, prestige remains insulated, but momentum has faded. Expect selective, affordability-constrained growth rather than a broad upswing.

Melbourne

Melbourne’s steady 2025 reset expectations for 2026. Rather than rolling over, the market is shifting into a value-led recovery, led by attached dwellings and affordable segments. Despite a raft of new property taxes, investor interest has returned, rental pressures are strong and supply remains scarce. Higher-priced houses may lag, but a necessity-driven catch-up phase is emerging.

Brisbane

Brisbane enters 2026 from a position of strength, but momentum is clearly easing as the market nears the top of the cycle. Migration and undersupply still support demand, yet affordability is now the binding constraint. Detached homes should lead, but growth is likely to moderate unless household incomes improve. Brisbane’s challenge in 2026 is not demand - it’s the limits imposed by its own rapid success over recent years.

Perth

Perth remains one of the strongest growth markets heading into 2026. Population inflows, relative affordability and acute undersupply continue to drive demand, with fewer affordability constraints than eastern capitals. Without a material lift in construction, Perth is likely to remain a national out performer despite its advanced cycle position. Good news for owners, much less so if you rent or are trying to buy your first home in the sandgroperland.

Adelaide

Adelaide’s outlook for 2026 is steady and resilient. Relative affordability is still underpinning demand, while modest population growth keeps volatility low. The market lacks catalysts for a surge but - for mine - shows little downside risk. Adelaide remains a defensive performer, appealing to buyers prioritising stability and income over rapid capital growth.

Hobart

Hobart enters 2026 stable but subdued. The soft 2025 outcome highlights sensitivity to interest rates and reliance on broader macro drivers rather than local demand. Buyer depth remains thin and price-sensitive, with adequate supply capping upside. Meaningful growth is likely to depend on stronger interstate migration rather than local fundamentals. Tasmania also needs a new stadium like a hole in the head. Heads?

Canberra

Canberra looks set for consolidation in 2026. A floor appears to have formed, supported by secure employment (the perks of having a Labor government) and steady owner-occupier demand (ditto), but high prices and balanced supply limit upside. Investor activity remains muted and growth is likely to track incomes rather than sentiment, pointing to stability rather than expansion.

Darwin

Darwin’s outlook for 2026 remains cyclical and uneven. Market outcomes continue to hinge on population flows, employment conditions and investor timing rather than structural undersupply. While short-term opportunities may emerge, sustained price growth is elusive. Expect volatility and sharp swings rather than a clear, consistent trend.

Gold Coast

Gold Coast housing held firm in 2025 as population growth and tight supply offset rising localised costs. Growth slowed a bit when compared to previous years, but values proved resilient. Detached homes continued to outperform, while parts of the apartment market became more price-sensitive. In 2026, the market looks mature rather than weak - selective growth, favouring scarcity and quality, with consolidation replacing acceleration. Yet a lot does depend on interstate migration and where is comes from.

Sunshine Coast

The Sunshine Coast cooled a fair bit in 2025 as affordability reduced buyer depth. Lifestyle demand remains supportive and limited supply puts a floor under values, but momentum softened outside prime coastal locations. In 2026, outcomes are likely to be uneven: well-located stock should hold value, while peripheral areas face longer selling periods and price points under replacement cost.

Toowoomba

Toowoomba surged through 2025, pushing prices to the peak of the cycle and stretching local affordability. Strong owner-occupier demand and limited supply drove rapid gains, but growth is now constrained. In 2026, the market is shifting into consolidation - much slower price growth, longer selling times and heightened sensitivity to interest rates rather than further acceleration.

Geelong

Geelong’s 2025 performance reinforced a two-speed market. Entry-level housing and attached dwelling stock has rebounded, while higher-priced coastal segments softened. Supply in growth corridors limited volatility but supported affordability-driven demand. Heading into 2026, modest and uneven growth is likely, with lower-priced segments outperforming and premium markets remaining subdued. Geelong really acts like an outer suburb of Melbourne these days.

Newcastle

Newcastle remained resilient in 2025, supported by demand for quality, well-located housing. Rate cuts lifted confidence, but affordability pressures made buyers more selective. Entering 2026, growth is likely to slow and fragment. Supply constraints provide support, but outcomes will increasingly depend on location, quality and realistic pricing rather than broad market momentum.

Wollongong

The Illawarra market stabilised in 2025, with strongest activity at the entry level and resilience in prestige coastal locations. New apartment supply around Wollongong CBD capped growth in that segment. In 2026, the market appears balanced, with modest gains likely but increasingly shaped by product type, supply and affordability constraints.

Oh yawn!

This is a new layer to the Matusik Missive. Yes, it’s a paid offering - but it’s designed to give you more, not to plead for a donation. Subscribers can ask questions directly, which I bundle and answer several times each month in paid-only posts. My aim is to explain what’s going on, not what you want to hear. If that appeals, come on in and let’s get the Q&A started.

PS And in reply for a few ladies (and one or two men) I know I am a handsome man, but once you got to know me, well new land speed records, when escaping, would be set. Like a bullet from a gun. If you stuck around you would need the patience of a saint, just ask Julia, my longtime suffering wife. Cranky is my motif. It took an age to get me to smile for this work pic in 2018. And just image how bad I look now! But thanks for the interest, love notes and potential rendezvous. Frankly I just want your money!

End note

Taken together, the my current Property Clock reinforce a simple point: Australia is not entering a uniform housing downturn. Most markets are still in recovery or upswing, but the cycle is clearly maturing.

Rising interest rates are (and will continue) slowing activity, capping price growth and exposing differences by product, price point and location. Structural supply shortages continue to place a floor under values, yet the conditions that drove the strong gains of recent years are fading.

In 2026, housing markets are likely to fragment further.

Prices should still rise in most capitals, but more slowly and unevenly, with growth increasingly driven by scarcity, affordability and local fundamentals rather than broad-based momentum.

Property “Find. Fund. Develop.” Event on Sat 7 + Sun 8 March, Burleigh Heads, Gold Coast

I’m speaking at the upcoming Find. Fund. Develop. event hosted by Unemployable Property - and it’s two full days of real-world deal analysis, funding strategies and development frameworks. No fluff. No BS theories. Just what actually works. If you’re serious about property, this is where you need to be.

Hurry some 300-odd people are expected and the fellas at Unemployable Property tell me seats are selling fast.