Imported buyers

They often set local prices and it's momentum

I’m often asked about “imported” buyers and whether they are pushing local dwelling prices beyond what locals can afford.

It’s a fair question and one that matters more than most people realise.

Listen

Last week, when I wrote about where dwelling values might head in 2026, I noted that locations with tight supply and a high share of imported downsizer owner-occupiers are likely to outperform the national average. The reason is simple: demand isn’t being set locally.

Revisit

Many of these buyers arrive with interstate - and often capital-city - price expectations. What looks stretched to locals still looks comparatively cheap to them. That perception gap matters.

Take the Gold Coast.

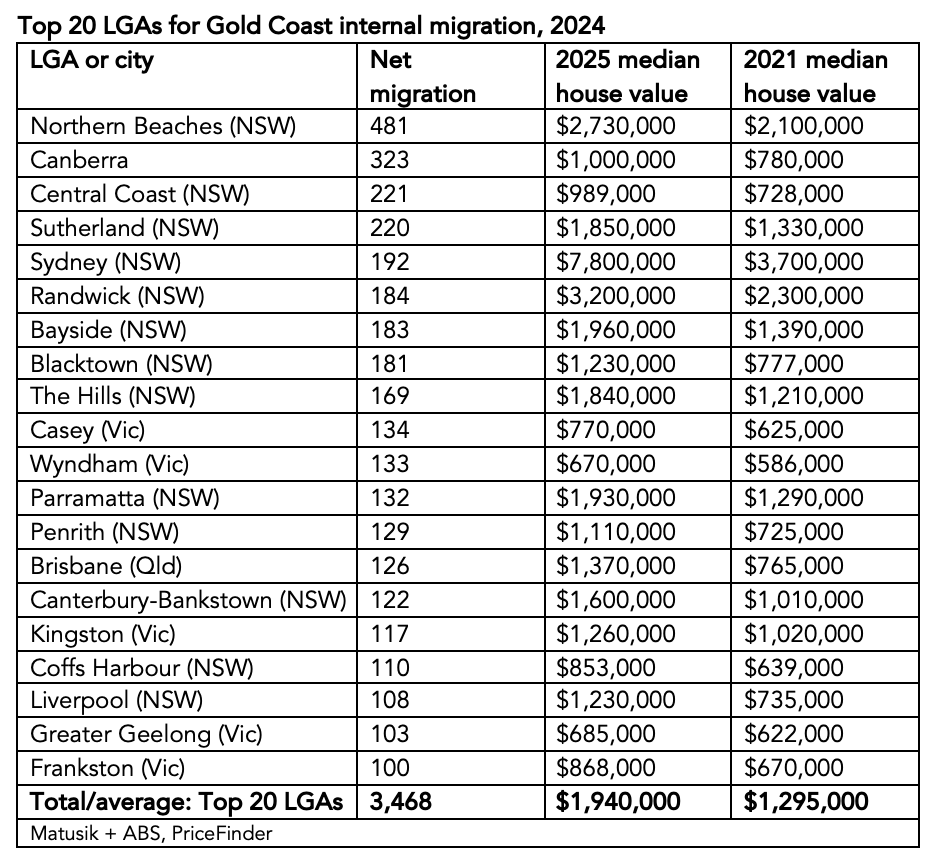

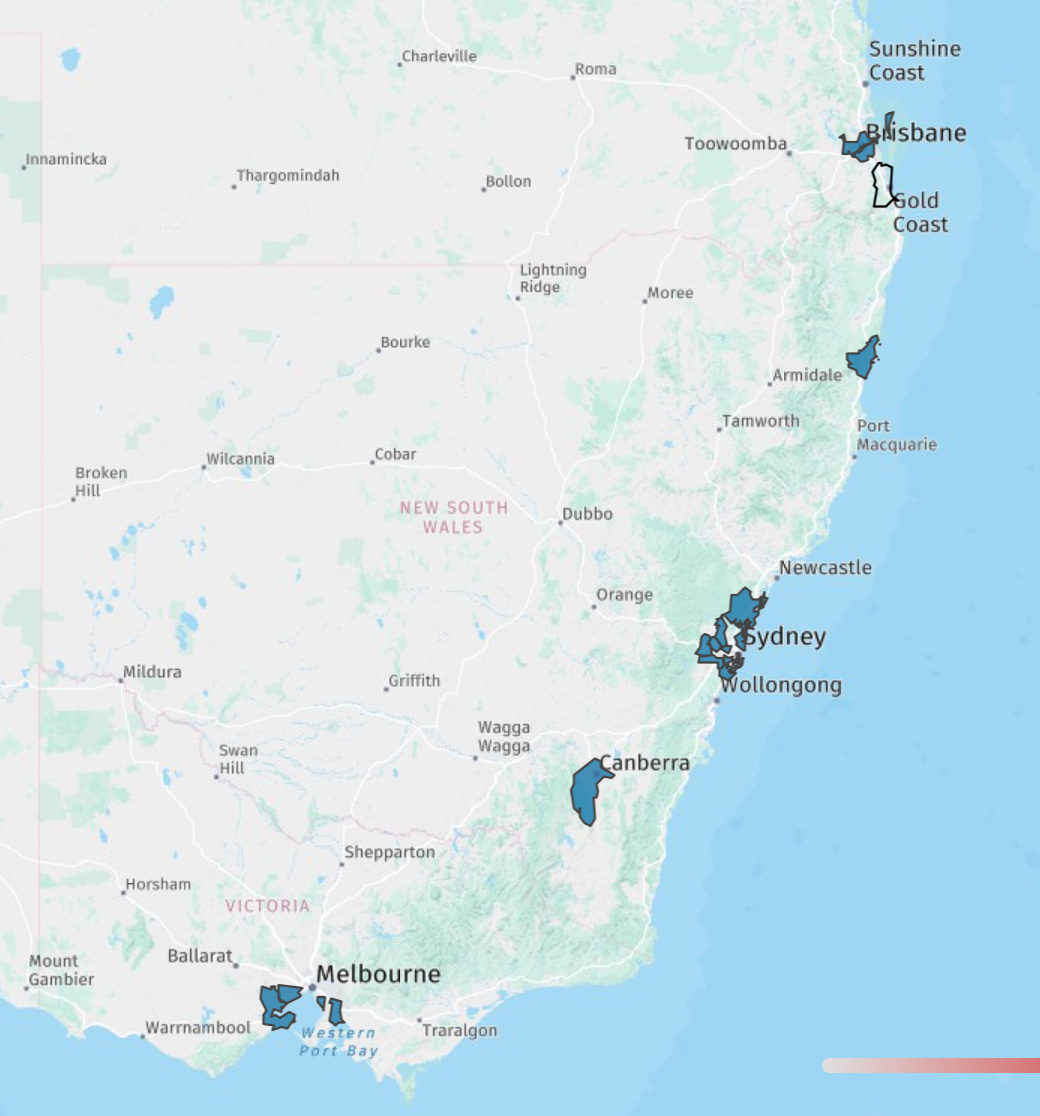

The top 20 LGAs feeding the Coast through net internal migration - dominated by Sydney’s affluent districts and Melbourne’s wealthier eastern suburbs - accounted for 23% of total population growth last year.

On a weighted basis, those source LGAs had a median house value of around $1.94 million, compared to the Gold Coast’s $1.3 million. That’s a 49% price gap, or roughly $640,000. From a migrant buyer’s perspective, that’s not expensive, it’s a buying opportunity.

Five years ago, in 2021, the gap was even larger at $735,000, or 76%. The differential has narrowed, but it remains meaningful.

This is why migration composition matters far more than headline population growth numbers. It’s not just how many people arrive, it’s where they come from, what they’ve sold, and what they think represents value.

For locals, prices may feel fully priced. But for a large share of demand-setting buyers, markets like the Gold Coast are still relatively affordable.

That’s why these locations are likely to see above-average price growth over the next few years, assuming, of course, that values don’t materially fall in the markets where migrants are coming from.

My hunch? Once that price gap compresses somewhere between 30% and 35%, the momentum starts to fade. There’s no hard science behind that just years of watching how buyers behave when the arbitrage disappears.