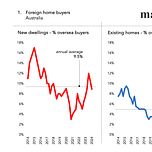

What we saw during the Covid period was not only a decline in population growth to Australia, but we also saw a drop in the interest from people living overseas buying new property and existing homes in Australia.

Ten years ago, some 17% of new homes sold to overseas buyers. This attention dropped to around 4% in 2021 and has bounced back since.

Whilst it's not actually allowed - although it obviously happens - when it comes to overseas residents buying existing homes in Australia, we have seen a very similar shape as the new house buying trends. Ten years ago, some 10% of existing homes were purchased overseas. It dropped below 2% or thereabouts during the Covid restrictions and has since lifted to 3.5%.

Overall if we take a decade-long average just under 10% of new properties across Australia sells to an overseas buyer and when it comes to existing homes that's about 5%.

Now in both markets, we have seen a bit of a drop back in overseas buying interest over the past twelve months. And I believe there are two factors in play.

Two influences

The first factor is that countries like the United Arab Emirates have made it very easy for somebody to live in that country. Nearly all restrictions on new migrants to the UAE have been removed and approval is fast. It is already one of the areas in the world which attracts a lot of wealthy overseas migrants, particularly from Europe and the Middle East.

And the second is Australia's current domestic situation and particularly what has been going on in the western and southwestern areas of Sydney.

Australia’s commentary about the situation in the Middle East, resulting tensions here and moreover Labor’s weak governance on this issue has scratched the world’s perception as Australia as a safe place to live.

This has especially been the case for millionaire migrants.

Millionaire migration

There is a substantial lift in the number of millionaires who are looking to migrate across the world.

Like all movements, the wealthy as moved less during the great pause (Covid). But the past trend upwards is back, and it's forecast that next year that 135,000 millionaire migrants will move.

To get into this club, you have a have USD $1 million and that money must be liquid. In other words, the $1 million is available to be invested.

Following the broader trends as outlined in our first chart this post, the overseas millionaire interest in migrating to Australia has also dropped over the past twelve months or so.

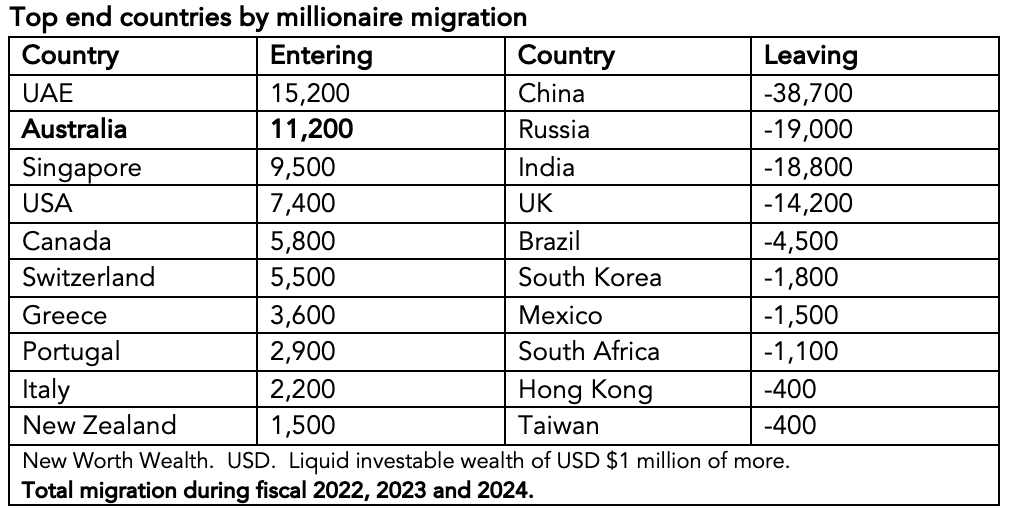

Yet Australia currently comes in second to the United Arab Emirates in terms of the countries which has attracted the most millionaires over the past three years.

Some 11,200 overseas millionaires settled in Australia between 2022 and 2024.

United Arab Emirates has attracted 15,200 such folks.

New Zealand attracted 1,500 millionaires (which is impressive given the countries size and isolation; although that is part of the attraction) and you can see in our table below that Singapore and USA and Canada have attracted a quite bit of interest too.

Where most millionaires left include China with 38,700 people leaving that country over the past three years. Then followed Russia, India, the UK, Brazil and the list goes on.

Interestingly, the UK has lost quite a lot of millionaires in the last year or two.

The rise in immigrants; the decline in local services; rising costs and poor local governance are said to be major drivers.

An Aussie bellwether maybe?

Millionaires intent and motivations

Some 37% of Australasia’s millionaires hold their wealth in housing. This is quite high compared to only the global average (29%). Again, in Australasia, only 10% hold their wealth outside of their country of residence and these millionaires, on average, hold three properties.

The main motivation behind buying a home in Australia include investment – that is for price growth. This is followed by lifestyle, and the third importantly is a safe haven. Now, out of six listed motivations, a safe haven ranks fifth on the global average, but it's third when it comes to Australasian millionaire investors

Australia has been a bright spot in terms of attracting overseas millionaires. Many of those people visit here, buy a house, stay and buy more properties.

Such activity adds to housing demand, and helps lifts housing prices, especially as one might expect across the top-end of the market.

The big winners here are waterfront suburbs in Sydney; inner city locales and acreage in Melbourne; Brisbane’s inner city and inner western suburbs; the Gold Coast in general; Noosa; Cairns; The Whitsundays; and the coastal suburbs in Perth.

End note

As mentioned before, overseas demand has dropped a bit of late.

Now we cannot do much about what other countries do, but we can definitely fix what we're doing at home.

Get more!

You may also be interested in getting my Sept. Qtr. Housing Market Overview + Outlook Video.

This 20 minute video holds 33 slides and is free to paid Missive subscribers.

This quarter’s video covers:

Current state of play

Population growth

Reasons behind price growth

Interest rates

Outlook

All charts and tables hold the latest data sets.

Upgrade to paid to access the video and to listen to, this podcast, and future ones too.

Alternatively you can buy my Sept Qtr. video for $25 by going here:

Listen to this episode with a 7-day free trial

Subscribe to Matusik Missive to listen to this post and get 7 days of free access to the full post archives.