This week we'll be talking about the housing market on a national scale and there are two charts as part of this missive and two tables.

This is my first Missive podcast and below is an edited transcript.

So, let's get going.

First, supply and demand drives real estate.

And you can see from our first chart that the number of dwelling sales - that is the demand side of things - remains elevated - whilst the amount of stock listed for sale is slowly easing.

When you do the maths and compare the two, you'll see that the line chart on the first chart display shows that the amount of stock for sale is in decline and there's only about three months’ supply in the market.

Now that factors in all supply, some of which is pretty crappy. So, if you take out the stock that's sticking there, particularly that that's been for sale for about six months or so, you'll find that the ‘saleable’ supply lines are quite tight.

As a result, prices are starting to rise again. They eased off a little bit during 2023 as interest rates rose.

And if you take a longer term view, they've increased substantially across Australia, with values going up 3.6 times since the Sydney Olympics in 2000 for houses and up 2.5 times for apartments and townhouses across Australia.

People often ask me how long the cycle is or how long it takes between peak and peak or trough to trough and the answer is on average about four years.

It used to be seven years and I used to advocate such as well, but things are getting faster not only in terms of the way we get our news and how we respond to it, but also in terms of how money's transferred and so forth.

So, we've got a cycle that is now four years, and I suspect in the coming decade or so, we’ll probably get closer to three.

Now, one of the things that's interesting is that when it comes to capital cities - a recent poll by API magazine - found that 70% of punters think that prices will increase over the next 12 months; whereas in regional locations, 53% think that they will increase.

Not many people in both camps - either capital cities or regional markets - think that they'll decrease over the next 12 months.

One of the other things that I think is important is that when we look forward, there are still people coming off a very low fixed loan that was established during COVID and about only a third of the people polled in that API survey believe that current households are currently under mortgage stress.

This is not as high as some of the newspapers have been reporting.

And for those who have low fixed rates and are likely to come off them sometime in the next six to 12 months - only one in seven (so about 13%) are saying they're going to have to sell their investment or another asset to make ends meet.

A large proportion of that market, something like 70%, have said they've negotiated a new mortgage rate and they've saved enough money to cater for the difference.

So that's a positive note.

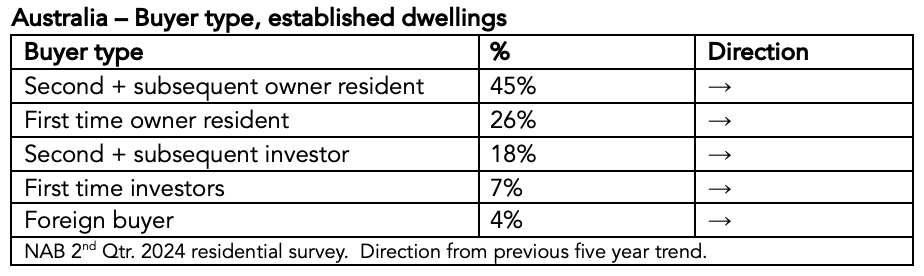

Finally, first table shows buyer type by established dwellings across Australia.

And all these market types haven't changed much over the last five years in terms of percentages.

A second and subsequent owner-occupier still dominates with a 45% market share.

And then 26% is first-time buyers.

Investors aren't that big a market across Australia - which rings true of when looking a longer-term trends – with about 30% of the population renting.

And this also indicates that it's going to be a struggle to increase the rental supply in the market moving forward.

In terms of housing preference for investors, detached housing still gets 30% of the market, although it's fallen in the last 12 month. Investor interest in apartments is 24% and this is rising, and townhouses are steady at about 18%.

The reason why detached housing is falling, I think is because the price point is getting too high, and the rental return isn't that great anymore.

Whereas investor interest in apartments is starting to rise because they're cheaper.

So, that it this week and thank you very much for listening.

This is my first podcast, so I hope you enjoy it.

Speak to you next week.

Get more!

You may also be interested in getting my Sept. Qtr. Housing Market Overview + Outlook Video.

This 20 minute video holds 33 slides and is free to paid Missive subscribers.

This quarter’s video covers:

Current state of play

Population growth

Reasons behind price growth

Interest rates

Outlook

All charts and tables hold the latest data sets.

Upgrade to paid to access the video and to listen to, the full podcast, and all future ones too.