New homes

My short term outlook for new housing starts

Short and sweet this week.

Very busy writing quotes and trying to meet consulting deadlines.

Not happy, Jan! Well, the bank account is.

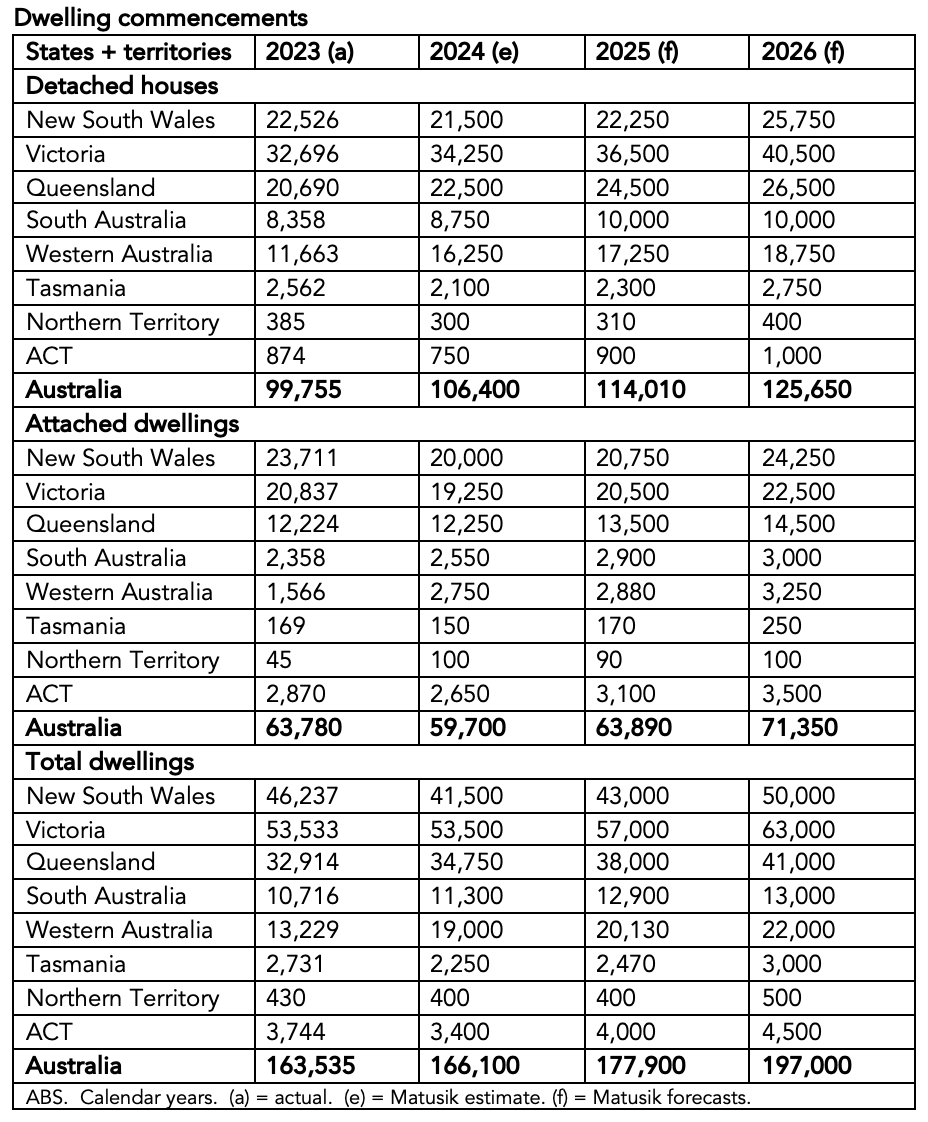

Many asked, following on from last week’s post, about future dwelling demand by year and product across Oz.

The table below supplies my answer.

Interest rates

Well down they fall, with another 0.25% cut likely in early April. And maybe more to come in 2025 too.

As outlined here and here lower job growth and rising unemployment is the real driver when it comes to the RBA cash rate.

Last quarter – ending December 2024 – there were 101,200 extra employed residents across Australia based on the ABS trend series.

Yet monthly, newly employed people, has been slowing down since August last year, where the monthly add was 42,000. In December it was just 31,000.

And forecasts suggest that the three-monthly average during 2025 will range between 58,000 to 78,000 per quarter.

The current 4% unemployment rate (again as per the ABS statistics) is likely to exceed 4.5% by mid to late 2025 if this lacklustre ‘job growth’ transpires.

So, today’s cut is likely to be one of many in the year/s to come.

As for inflation. There is lot of nonsense written about the Trump and geopolitics these days and its inflationary impact. But more on this soon. But for now, revisit here.