Where interest rates head in Australia next year and beyond depends not on inflation per se but what happens with new job creation. This impacts the unemployment rate and, in most situations, the level and direction of inflation.

So looking forward it is all about jobs.

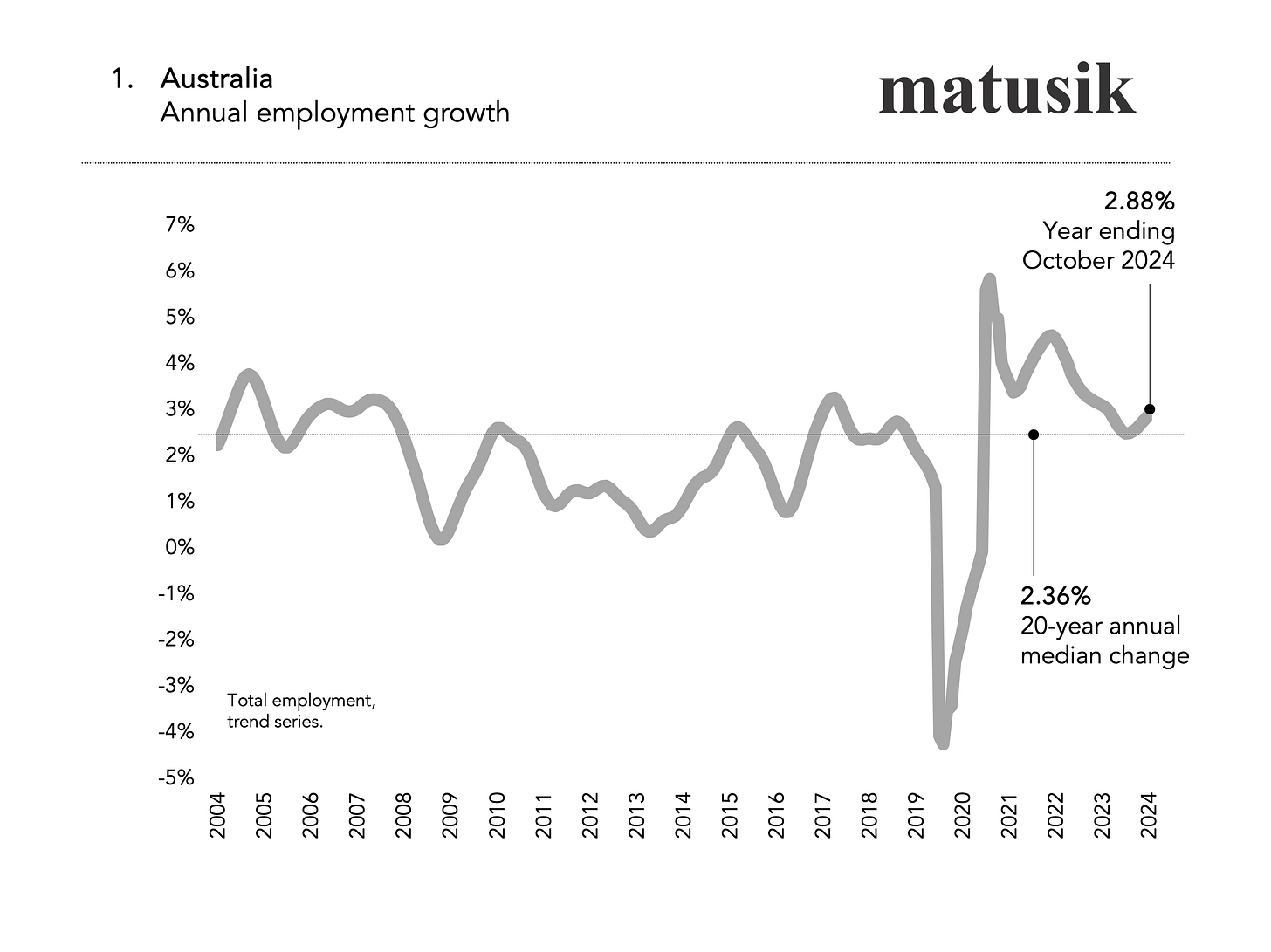

Our first chart shows that the annual rate of job creation is currently above the long-term average. Good if you are looking for work but not so much if you have a big mortgage or outstanding loan.

Yet the ‘good’ has a big caveat too, in that many of the new jobs created over the past couple of years have been in the public sector or in government aligned work.

Nevertheless to the RBA and many economists see these as “real” jobs.

Well I do remain sceptical. But maybe that is just me.

The second chart shows that there is a strong relationship between the job growth trend and when the RBA lifts and cuts official interest rates.

If we see job growth start to trend downwards – and especially below the long term trend - then interest rates here will start to fall.

Chart 3 shows that the financial markets expect rates to fall, but they aren’t as keen as they were a few months back.

For that blame the little recent tick upwards in the annual job growth trend as shown in chart 1.

Looking forward

Today’s RBA meeting (3rd December) wasn’t ever a “live” one. They had no quarterly CPI cover.

The next meeting is on the 18th of February where they might drop the cash rate by 0.25%. Might.

This meeting will be after the December Quarter ABS CPI result out in late January.

I expected the cash rate to fall last month. Many of you will recall that I said that.

I anticipated that new job growth would have slowed more, as the new labour laws kicked in. Maybe I just got ahead of myself.

But maybe not given that two-thirds of the recent new work has been government-related, and the current federal government has no shame when it comes to spending our kids and grandkids future, so maybe new job creation will remain artificially elevated.

2025 is an election year after all.

Watch this space.

But wait there is more!

For paid subscribers – and thanks - behind the paywall is a table of Australia’s top 50 local council areas ranked by new job growth over the past five years and over the last year.

Some surprises in the mix.

Join the paid Matusik tribe to get the table plus my past missives, my recent outlook video, podcasts and also you can save 20% on the Ready Reckoner reports for SEQ LGAs.

Just $330 per annum or $55 per month. Includes GST and most likely tax deductible.

You save 50% if you sign up for the year.

A bargain at twice the price!

The usual T & C’s apply.

Keep reading with a 7-day free trial

Subscribe to Matusik Missive to keep reading this post and get 7 days of free access to the full post archives.