A few years ago, I was asked by a group of my Missive subscribers to outline what I would do if I was the Federal Housing Minister.

This is what I outlined.

So, what would I do if I was the Federal Housing Minister?

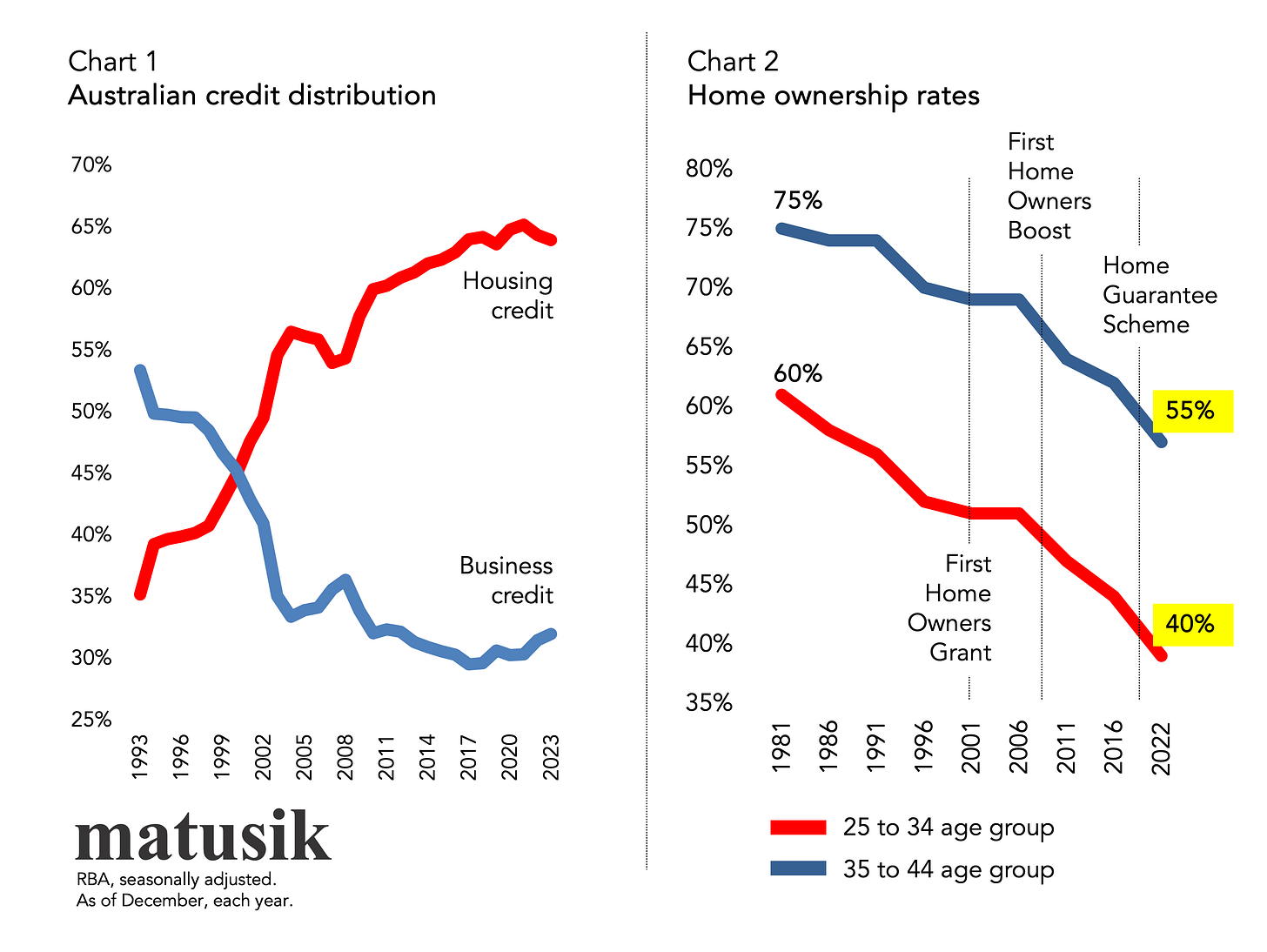

At present over 60% of our domestic credit goes to housing related activities and just over 30% goes to business. A generation ago these were the opposite. See chart 1 below.

This is one of the most telling charts on the Australia economy, yet it gets little airplay nor is it regularly updated.

My aim – as housing minister – would be to reverse these proportions over the next 25 years, if not sooner.

That said, here are the ten things I would do.

1. All states/territories to remove stamp duties and federally we will remove the investor capital gains tax discount and negatively gearing tax breaks for resale homes. This would be phased in over a five-year period for investors who currently negative gear. Also, negative gearing for new homes would only stay in play for five years too.

2. Impose a broad-based land tax on all properties set at between 2.5% and 5% per annum, depending on use, tenure and length of time held. Overseas interests pay a higher rate per annum. Too many land-bank.

3. Introduce a capital gains tax on all properties, with the percentage set to decline on length of time held – under 2 years say 20%, 2 to 5 years 15% …. over 25 years 1% etc. This is to help stop flipping.

4. Stop all first home buyer grants and related gifts – they just stuff things up by making housing less affordable, distorting the building cycle and resulting in fewer first home buyers than would otherwise be the case. See chart 2 also below. I would also cancel Housing Australia Future Fund and other associated largesse. Government get out of the way, you suck at building homes! Embolden private industry to build.

5. You cannot use more than 50% of your SMSF assets to buy an investment dwelling/s.

6. Same set of development and building rules across the country varying only due to climatic conditions.

7. Infrastructure charges per new dwelling are also the same across Australia, set at 5% of final vacant land or new dwelling sales price (and not a flat fee) and payable on final settlement.

8. Caveat emptor applies to all buyers – off-plan included and especially high-rise apartments. And developers and builders are responsible for all shonky workmanship, within a specified time frame and with fair caveats, not the general public.

9. No Australian Passport, No Buy – regardless of dwelling type, development status or origin of purchaser.

10. And this last one is really self indulgence, and maybe not that important, but a particular bugbear to me. All publicly promoted/exposed housing market-related research, such as price growth predictions, must go through a peer panel review and an equally weighted ‘con’ argument must run alongside the ‘pro’ pitch.

Western Australia commentary

A few weeks back my new dwelling demand and supply post suggested that both South Australia and Western Australia could face an oversupply of new homes in coming years.

The oversupply for SA could be 28% and 40% for WA by the end of calendar 2026.

A few subscribers blow a gasket and asked me to explain.

That post I reckon cover the South Australian outlook in the footnote. Revisit here.

So when it comes to Western Australia, my new dwelling supply outlook was on average 21,000 new starts per annum over the next two of years. Last year some 17,500 new dwellings started construction across the Golden State. This is up from 13,250 during 2023. New housing starts have also been trending upwards over the past three years.

In addition some 4,000 dwellings across WA - many of them detached homes - have been approved but haven’t started. Most (90%+) will start and usually quite quickly.

Furthermore, backyard homes are allowed and in fact, from late 2024, encouraged.

This great policy setting will also add to new housing supply. And maybe quite significantly so.

Exclusive tax depreciation offer

60% of property investors are handing the ATO thousands of dollars every year by not claiming tax depreciation. That’s money that should be growing your portfolio - not funding government largesse.

That’s why I’ve partnered with Koste Chartered Quantity Surveyors, Australia’s leading tax depreciation specialists, to offer my tribe an exclusive discount on their premium service.

📌 Exclusive Offer: Tax Depreciation Reports for $595 + GST (Normally $695)

📌 Use Promo Code: HKEJGDRY

✔ Maximise Your Deductions – Even if you already have a report, you could be missing out.

✔ Industry-Leading Technology – Koste ensures you claim every dollar possible.

✔ ATO-Compliant & Expert-Backed – Chartered Quantity Surveyors, not just any provider.

This offer is only available to my network - don’t leave money on the table.