The Missing Middle

What does the future hold?

For mine demographics shape almost everything.

Future demographic shape

If that is true, what does Australia’s demographic shape look like over the next five years?

The first table shows that baby boomers, who were helping drive generic house price growth over the past two decades, are now starting to downsize.

Also coming through are more first home buyers. This segment is expected to see the largest growth in the coming decade. High overseas migration – whereby the average age of a new overseas migrant is 29 years – means many more potential first home buyers.

Some comments

Most aging baby boomers look to downsize/retire in their local area.

But most are not that interested in trading in their detached home for a tight mid-to-high rise apartment. A ‘middle ground’ product is really wanted. Better still, is one which can accommodate a relative, grandchildren, visitors, a tenant and in due course, a carer.

First home buyers often need assistance to help pay the mortgage. Many now take in a tenant.

My Housing Demand Model

Our modelling suggests that more housing that fits between a small apartment (often downtown and in large, soulless complexes) and traditional detached homes will be needed.

This housing is often, these days, described as the “missing middle”.

More detail

Breaking this demand down further, our work suggests that the demand for housing that caters for sharing is very high – up to 25% – over the next decade.

At present, less than 5% of Australia’s existing housing stock successfully caters to this market.

See the second table for more detail.

End note

Looking forward, I believe that many Australians will be forced to compromise on their housing. This is already happening in many locales.

And if I am right – what is often labelled as the “missing middle” these days – should better weather the storm.

To that end, multi-occupancy property is looking more promising rather traditional housing. This applies to owner residents as well as investors.

For investors, multi-occupancy product already shows a much higher return than most other housing types. More people are sharing accommodation and a key to getting a better rental yield is to hold property that facilitates sharing.

For mine an astute passive investor will buy strategically for a rental return and not just buy a common property in anticipation of generic price growth.

They will also buy a property with strong owner-resident resale appeal. This increasingly will mean a dwelling which appeals to multi-generational households.

Postscript

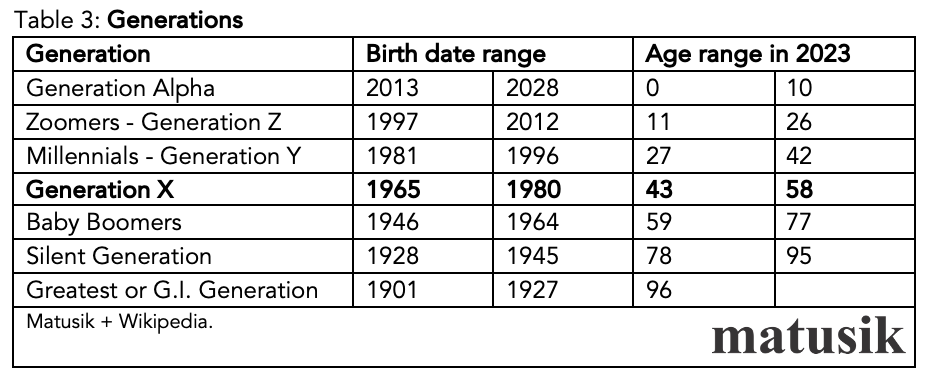

Table 3 outlines how I have defined generations. For your information.

Get the full picture

The Matusik Missive comes out on Tuesdays at 8am and 48 times each year.

I do like to take a bit of a break over Easter and around Christmas/New Year.

Each post holds either extra datum, fuller text, my spoken word and sometimes video content. Yikes!

But to get this extra stuff - plus search all my back issues and make comments - you will need to join the Matusik Missive Plus tribe.

This will cost you some coin – paid either weekly or on an annual basis.

You will also get free access to my quarterly market overviews and get a discount on my Ready Reckoner reports.

You can sign up for free, but you can only access my content for two weeks after posting and you cannot join any public discourse.

I hope you join the Matusik Missive Plus tribe.

If you do, me, and my bank account, say thanks!

Click on the red blob below to find out more.