Pulse points

A deep dive into Australia's wealth generators

You, dear reader, are long overdue a protracted Missive post.

My aim this Missive is to set that right.

So here goes.

Synopsis

A select few areas in Australia generate most of our wealth.

Whilst some are often a very long commute from where many Australians live, in general more people want to live closer to these economic generators, hence the rising attraction for more compact living.

But most cannot fit into or afford to live in a downtown apartment.

More infill development is needed, coupled with better transport infrastructure, plus an active government programme to decentralise some of our knowledge-intensive work activities to our more suburban and regional settings.

A brief history

Just over 100 years ago, we were living our reputation, that is dependent on the bush.

About four million Australians lived on rural properties or in small towns of fewer than 3,000 people. Most were market towns, serving the agricultural economy.

Only a third of Australians lived in a city the current size of Toowoomba (i.e. over 100,000 people). Primary production, including mining, was almost all we did.

Post WWII, manufacturing took over from growing and digging things, accounting for a quarter of the workforce and a third of our GDP.

This led to a rapid rise in household wealth and a big shift to urban living, especially suburban homes.

By the time I was born – the mid-1960s (and yes, I know I look much younger!) – three out of five Australians lived in a major city.

Manufacturing has greatly influenced how our cities are laid out. Industry needed cheap land.

The rise in car use and ownership helped make manufacturing and suburbia go hand in hand.

By the time I started high school – and yes, the best music is from the mid to late 1970s, no debate! - four out of every five trips were made by car.

Today

Fast forward to today and Australia is no longer driven by what we make, but rather by what, and who, we know.

Yes, mining has been pivotal to our economic growth, but it employs just 2% of the workforce and yet now only makes up 14% of Australia’s GPD.

In contrast manufacturing holds a 5% market share these days - a crying shame if you ask me and something that needs fixing and fast - whilst the service industries accounts for 63% of our economic grunt.

Our economy is increasingly becoming knowledge-intensive, more specialised and much more interconnected.

Think – “specialisation of labour” – three very important words to really grasp.

Australian pulse points

Did you know that just ten areas account for almost three quarters of our economy? That’s 76%…and that isn’t a typo.

And that some 54% of your GDP is held in the urban belt between Brisbane and Melbourne. With another 16% held in Western Australia and mostly then in Perth.

It is little wonder that this is where most people live and the vast proportion of people move to, either domestically or from abroad.

My first map this post maps the Australian economy.

Of course, in each major economic pulse point, business activity is more concentrated in some parts and less so in others. In fact, many parts of Australia’s cities produce relatively low levels of economic activity, despite a lot of people living there.

Even regional economic activity and its growth are tied to our larger cities.

Regions within an acceptable commuting distance are typically growing much faster than more distant regions. There are exceptions of course – but only a few - like in WA and regional Qld.

Many outer conurbation residents in these areas of low economic activity and commute to work in employment nodes. Hence the increasing traffic!

More detail

My work is based on areas known as SA4s by the ABS.

SA4s (broadly) represent labour markets and generally have a population between 100,000 to 600,000 people. There are 108 SA4s covering all of Australia, yet Gross Regional Product estimates are provided for just 88 SA4s. These include 46 capital city SA4s, and 42 SA4s in rest of state or regional areas.

Three tables – for my paid subs – have been included behind the paywall which outline the economic size of each of the 88 SA4a.

My bonus tables show that inner city locations often generate most of a capital city’s economic growth.

Why?

Because businesses are more productive when they interact with larger numbers of customers, suppliers and competitors – and when they are forced to do so with more frequency.

Again, think “specialisation of labour”. This is the real force shaping whatever lies ahead – urban development, jobs, investment, wage growth etc.

The same phenomenon applies when looking at why larger cities are more economically productive than smaller ones, or those in other parts of country.

Also included in these bonus tables is a breakdown of the local economic value per person or capita. Again, this detail is provided for each of the 88 SA4s across Australia.

Per capita

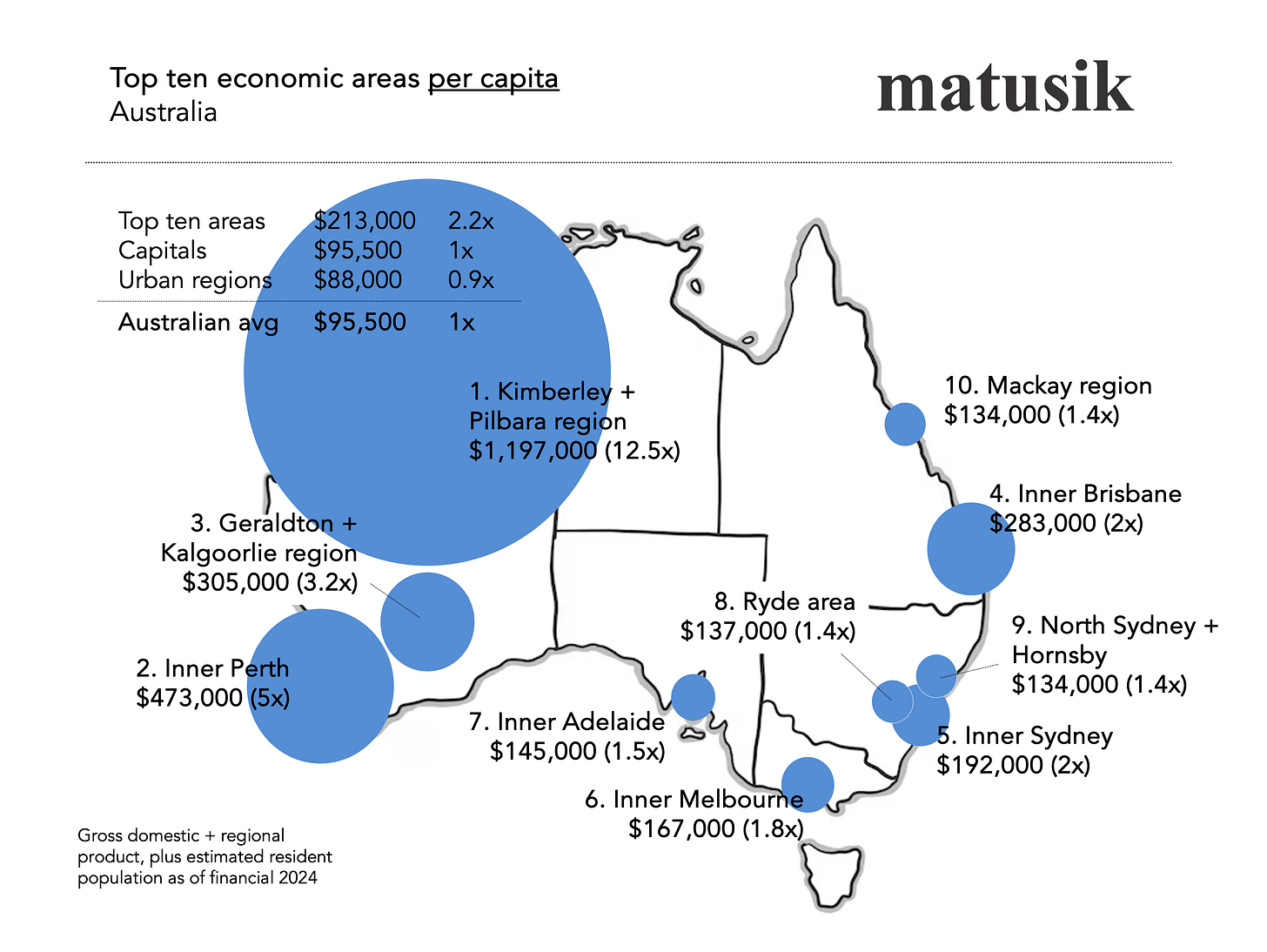

And on that note, Australia’s current economy is worth around $95,500 per person.

Major urban regions are worth a bit less than the Australia average, whilst the top ten per capita pulse points are valued at much more.

My second map shows Australia’s top ten economic pulse points per person.

Today’s conundrum

Most Australians today are employed in the service industry; and whilst a lot of these are becoming more knowledge-intensive, or at least involving greater use of technology, seven out of ten jobs remain outside of our inner-city areas.

It’s true that many knowledge-based workers believe that the benefits of living close to the city outweigh the higher cost of housing; less dwelling space and generally greater expenditure needed to be an inner-city resident.

But many of us cannot afford to live downtown. Yet, for the economy to function, we do need to live within an acceptable commute to work.

Even more so, if we are to see more part-time jobs being created in the future.

This casualisation of the workforce is due, ironically, somewhat to our greater use of technology and increasing emphasis on becoming a more knowledge-based economy.

So, either more infill housing needs to be built across our middle and outer city suburbs; or we need better transport systems (which might simply mean making them free or in SEQld’s recent case just 50c per journey) between home and major places of work; or more knowledge-based work needs to be moved to where people currently can afford to live.

A combination of all three is what’s really required to help Australia’s economy grow.

And as I have said several times in recent years, Covid’s impact has had limited impact on these broader trends. We have seen a massive reversal of work at home over the past twelve months and more is likely to follow this year as our economy (and maybe the world’s) faces rising unemployment and much more uncertainty.

And let’s revisit that why?

Businesses are more productive when they interact with larger numbers of customers, suppliers and competitors – and when they are forced to do so with more frequency. This means face to face interactions. Zooms and TT only go so far.

One sure way to lift the countries lagging productivity is have workers turn up. It is no accident that the biggest blobs on my second map have high levels of on-the-job workers.

End note

It appears somewhat safe to assume that the service industry will remain our biggest source of employment and increasingly the muscle behind our economic growth.

Once more – “specialisation of labour”.

Most service-related jobs are concentrated in small areas. As a result, our economy is – as our map clearly shows – clustered into a handful of urban areas – and within them, in even tighter geographic confines.

This geographic trend looks set to continue – even accelerate – into the future.

That being true, then it looks to me that it would be best buying an investment property in one of the bigger red or blue dots on my two maps, rather than in a more regional locale.

Of course, good exceptions do apply.

And to find out where these bigger regional and internal capital city blobs are, become a paid sub today!

When it comes to buying within an area itself, it might be best to buy as close to one of the city’s economic “pulse points” as you (and your tenant profile) can afford.

Hypocrite?

Many of you know that these days I work remotely. Well, I have done for over a decade. And since Covid we live on our small farm holding an hour south of Hobart. I work very hard to stay in contact with what’s going on. This involves travelling to the mainland (and sometimes NZ) every second or third week and when I do I make time to visit projects and development sites and meet with clients – past, current and prospective.

Yet it is not lost on me that – to misquote Dylan – “I have become my enemy. In the instant that I preach”. My Back Pages

But I do think that Mellencamp, in this instant, is more apt.

And again, I slightly misquote “Hypocrite used to be such a big word to me. It doesn’t seem to mean anything to me now”. Between a Laugh and a Tear.

Enough already!

And to all you Darwinites, I am coming up your way again soon.

No not to go fishing, but to bore you to tears.

Lucky that Will and Stuart are speaking too.

The event is on Thursday 3rd April at Sweethearts from 5.30pm.

Cold beer and wine will be served, plus slow crocs and wild buffalo. Don’t fear they both taste like chicken!

Click on the red blob to book your seat.

Attendees will get my chart pack and a short Darwin market outlook summary. Groan!!

Three detailed tables follow for paid subs only. Thanks for your brass!