Analysis by BDO recently claimed that Australia’s build-to-rent (BTR) sector is now worth more than $30 billion.

The report trumpeted 39,300 apartments “built, under construction or in planning” and celebrated the fact that nearly three-quarters of these projects are being bankrolled by offshore capital.

The spin? That BTR is booming and set to make a meaningful dent in our housing crisis.

The reality? Not so much.

Scale vs. supply

Australia builds between 240,000 and 250,000 new dwellings a year.

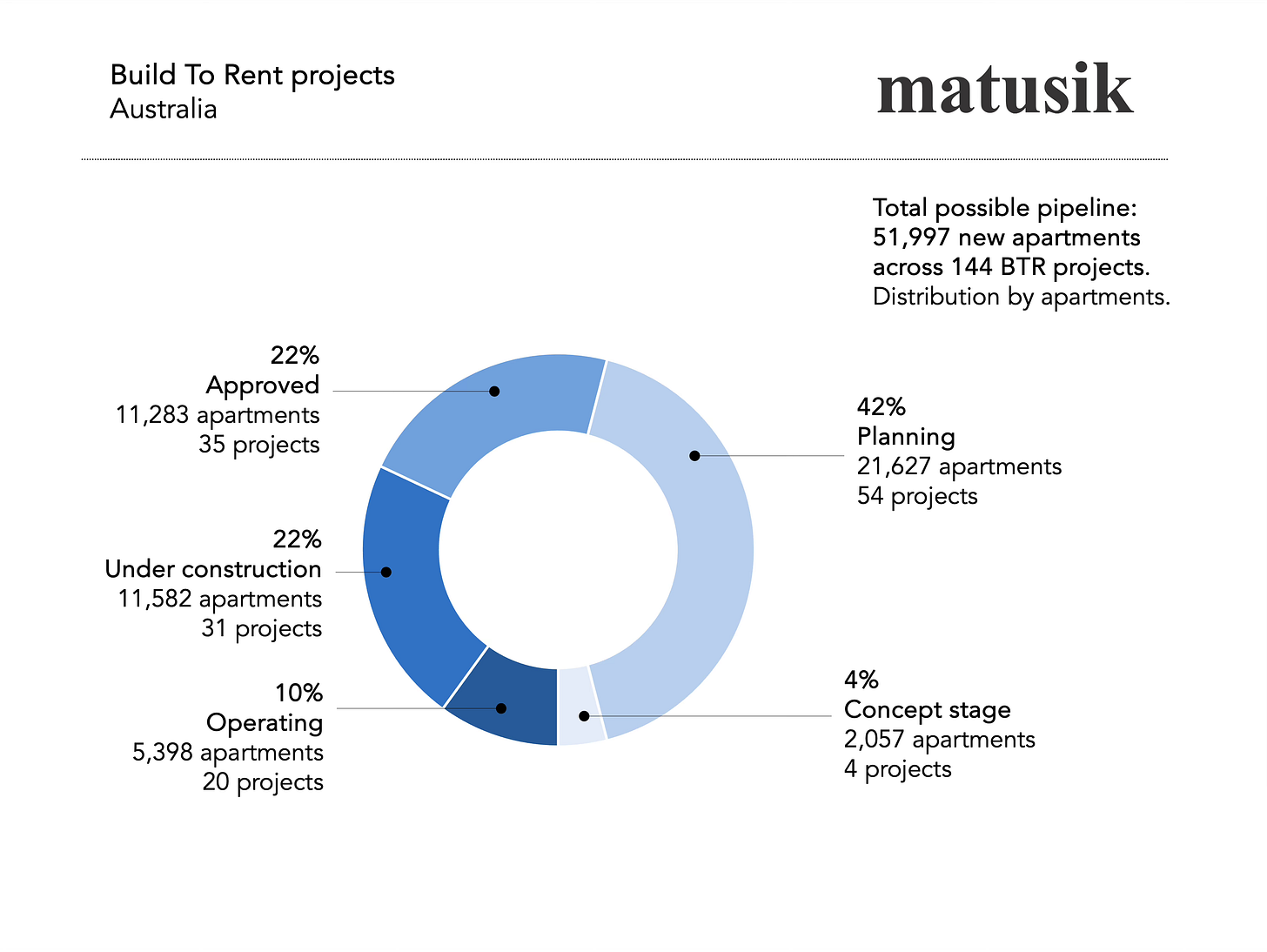

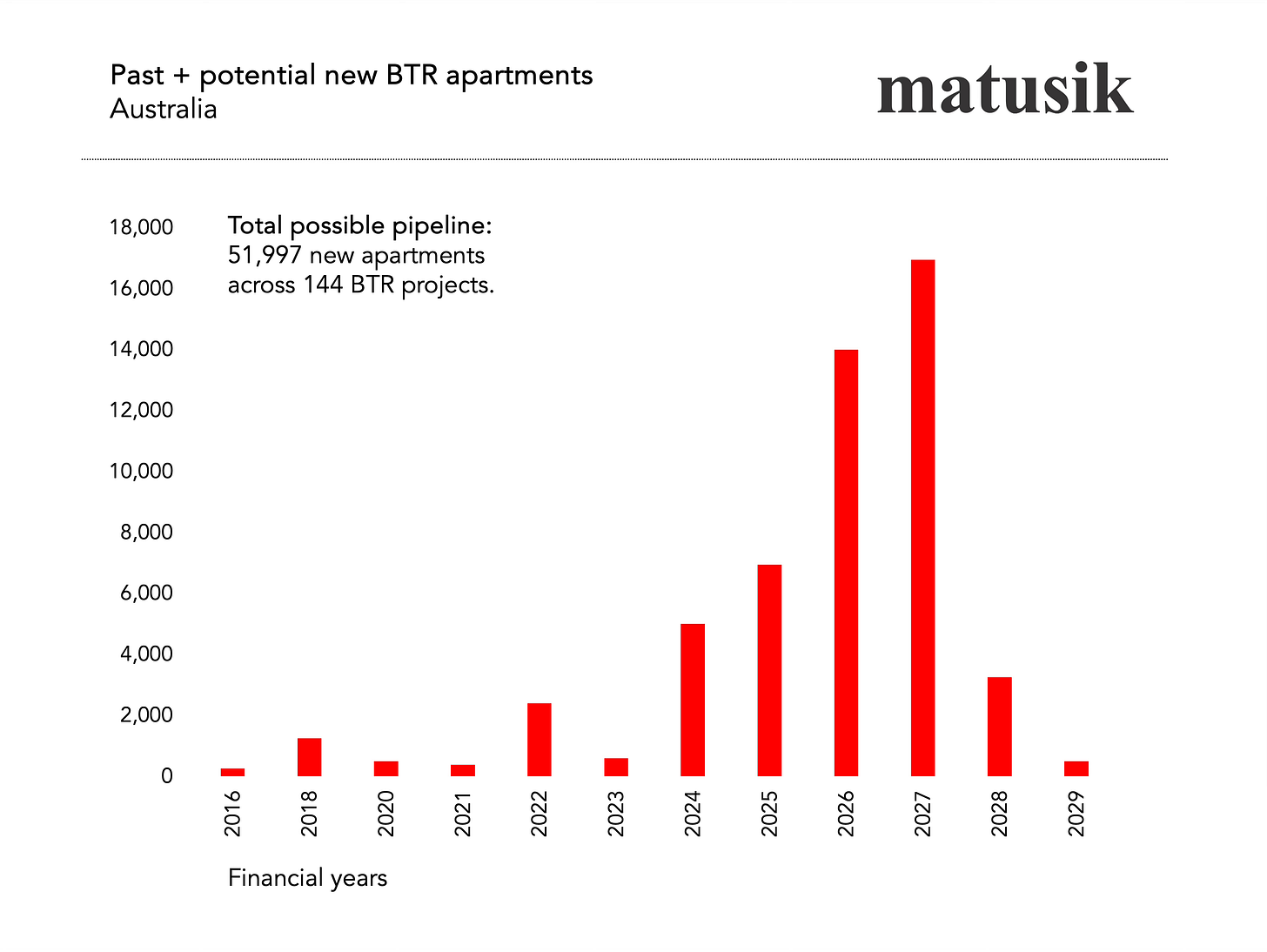

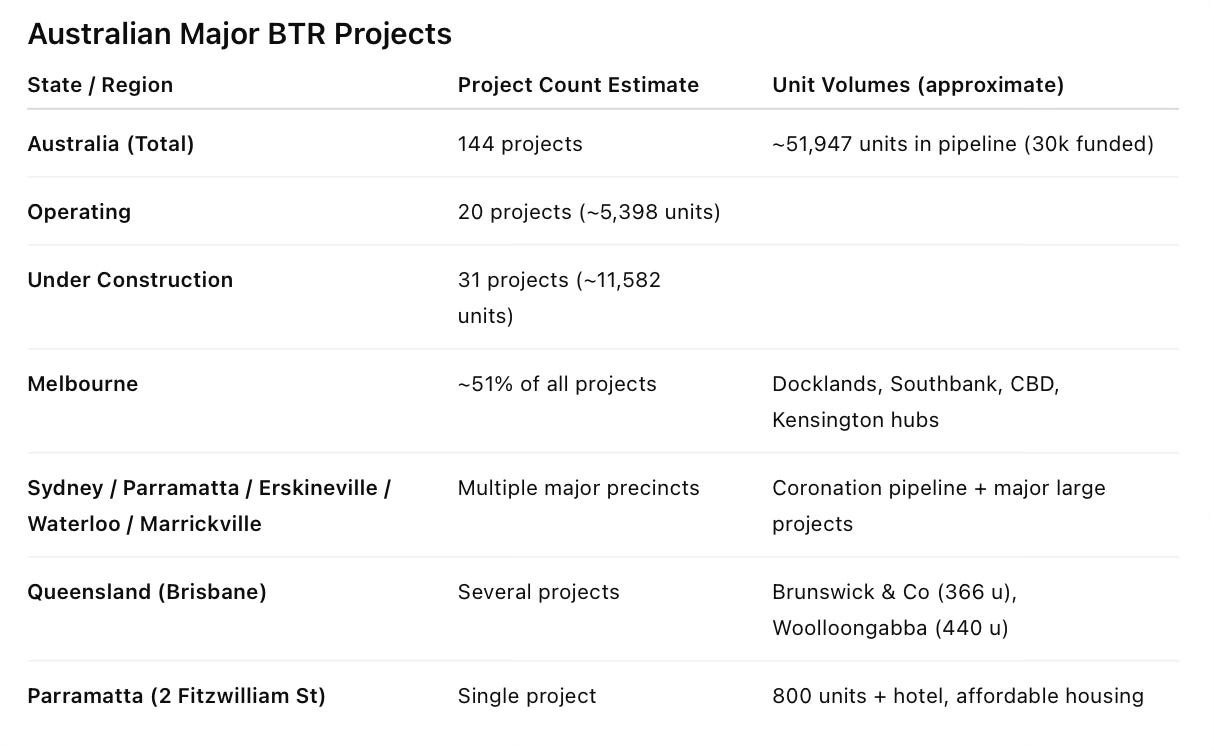

Even if every single BTR unit in the national pipeline were delivered tomorrow, we’d be looking at about 52,000 apartments in total.

But let’s strip it back:

· Only about 5,000 are operating today.

· Another 11,500 are under construction.

· The balance is “approved” or “proposed” - which, in my mind, are really paper projects.

So, in practical terms, BTR makes up 4% of new housing supply at best. But more likely, even less.

That’s not a solution. It’s a niche.

Cost to rent

Another uncomfortable truth: BTR apartments are expensive.

They’re marketed as “lifestyle rentals” with gyms, rooftop bars, dog washes and co-working hubs. These perks are nice, but the reality is most BTR rents sit 10% to 15% above comparable private apartments in Sydney and Melbourne.

Yes, a handful of developments include a slice of discounted “affordable” stock, usually 10% to 15% of units. But the overwhelming majority are pitched at affluent tenants - not families, not key workers, and certainly not renters struggling with affordability.

Help me help you!

Each weekly missive takes up to a full day (sometimes more) to research, write and refine - your support helps keep them coming, sharp and independent.

Who really benefits?

If BTR isn’t about affordability, then who wins?

· Institutional investors, many based offshore, who like the long-term cashflows.

· Super funds, who see stable rental income as a hedge.

· Governments, who can issue glowing press releases about “X thousand new units” without fixing land release or planning bottlenecks.

For the tenant, the “win” is less about the gym or the rooftop — and more about security of tenure.

Longer leases, no threat of the landlord selling tomorrow, professional management, and transparency on rent increases. That’s what tenants are paying the premium for.

Facilities? They’re window dressing.

Overhyped & underdelivering

Strip away the marketing gloss, and the story is simple:

· BTR is too small to move the needle on national housing supply.

· It’s too expensive to help with rental affordability.

· And its much-vaunted facilities are secondary to what renters truly value: stability and service.

In other words, BTR is best understood as an investment product with a housing veneer. A boutique option for high-income tenants, not a mainstream fix for Australia’s rental crisis.

Bottom line

BTR is being hyped as a saviour, but it’s just a sideshow.

It will polish a few skylines and provide comfort to some well-heeled renters, but it won’t solve the housing crisis.

If anything, the premium tenants are paying proves the point: in Australia’s broken rental market, certainty itself has become a luxury good.

But we can do really things in this space! More on this next week.